Share

0

/5

(

0

)

Thanks to the numerous digital innovations, it has become exponentially more straightforward to simply sign up online and access the large trading markets previously out of reach. The trading realm is no longer exclusive to professional brokers and wealthy investors. However, behaving professionally and wisely in this landscape is no less essential, as the trading field is quite challenging and frantic.

Understanding your private earnings and profitability is one of the most essential aspects of trading. This article will discuss the open P&L meaning, its major subtypes and why you should closely monitor this metric.

Key Takeaways

Open P&L is an automatic report generated by online trading platforms to describe the profitability of all open positions by a particular trader.

Open P&L is a great tool to assess the performance of open positions and choose the best course of action from now on.

Understanding that open P&L profits will only become actual if the positions are closed is crucial.

Profit And Loss Statements: Finance Vs. Trading

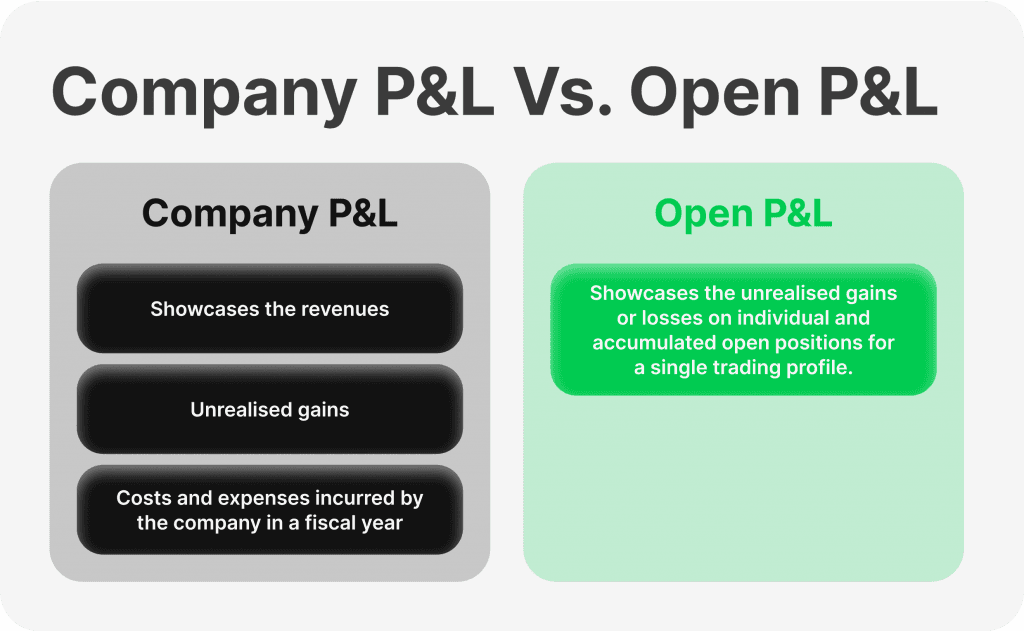

The term P&L stands for profit and loss statement in the financial context. Generally, the P&L statements showcase the bottom line net income or losses of the company in a specified period, usually a single fiscal year. The purpose of company P&L statements is not just to showcase the bottom line but to thoroughly document all the factors that shaped it in the current period. Thus, the P&L report gives the company stakeholders a good understanding of the recent progress and possible improvement areas to accelerate growth.

The Open P&L in trading has the same purpose, but for the individual investors who wish to fully grasp the effect of their strategies. Usually, the primary output of open P&Ls is showcasing the results of all trading positions an investor opens. However, more advanced versions also offer the progressions of these positions and the critical changes in the trading trends along the way. Open P&Ls are outstanding reports, allowing investors to monitor their winnings or losses and adjust strategies closely.

Open P&L Meaning and Importance For Your Trading Strategies

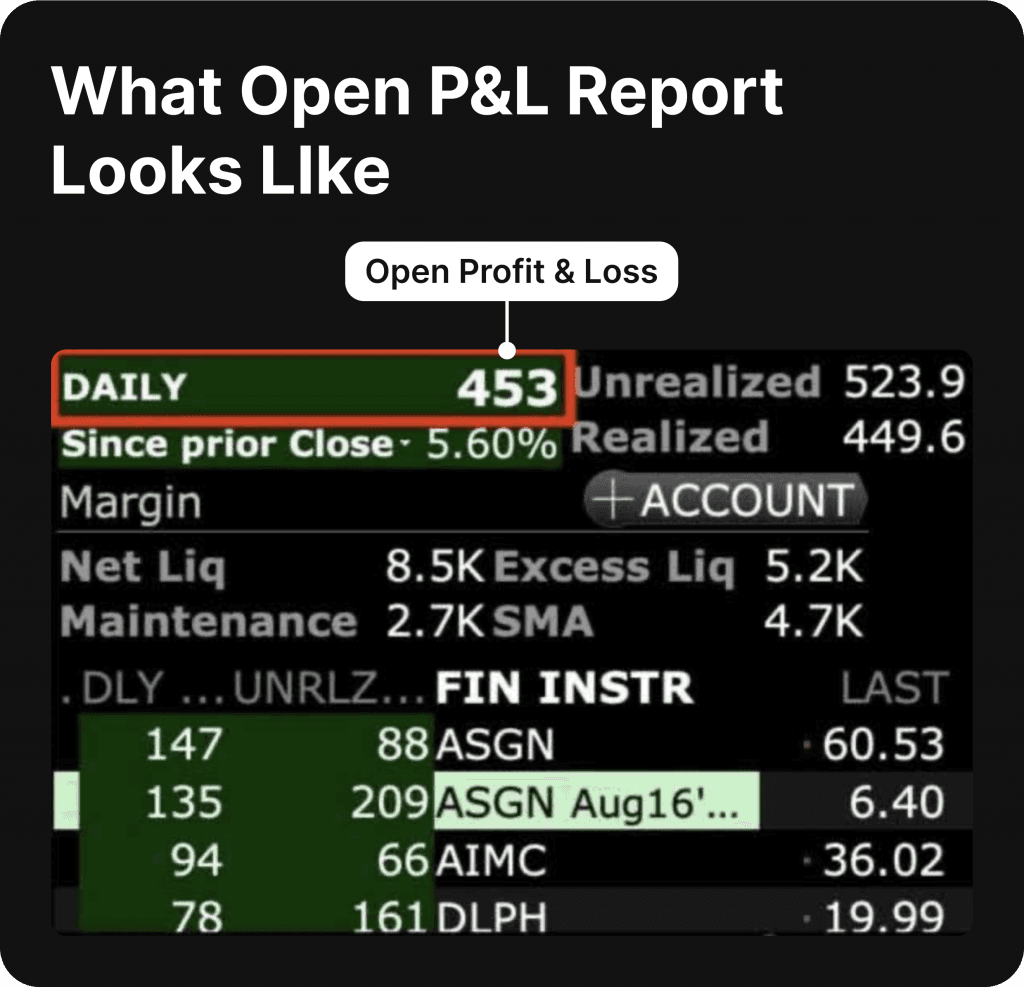

So, the open P&L statement is one of the crucial reports you can analyse during trading activities. After all, the most critical metric in trading is the profitability of open positions, and it is vital to see if the initial strategies are producing the desired results. While it seems trivial to have such reports at your disposal, it used to be much more complex and cumbersome to check the trading profitability in the past.

Today, most online trading platforms have the function to showcase open P&L statements in real time, which is quite a luxury. As a result, traders can simply access their reports and analyse the profitability of their trading strategy. Sometimes, it is essential to monitor the open positions in a unified order to get a complete picture instead of looking at the isolated information. Open P&Ls are especially useful to investors who hedge their bets by employing opposite strategies or shorting the tradable assets.

In this case, traders can swiftly check if their risk management tactics are fruitful and if their portfolio safeguards function properly. Moreover, an open P&L allows traders to monitor the relationship between their open position and the market changes that transpire in real-time. As a result, investors can pivot, close positions or open new ones without missing a beat or incurring losses.

Understanding The Unrealised P&L (Floating P&L)

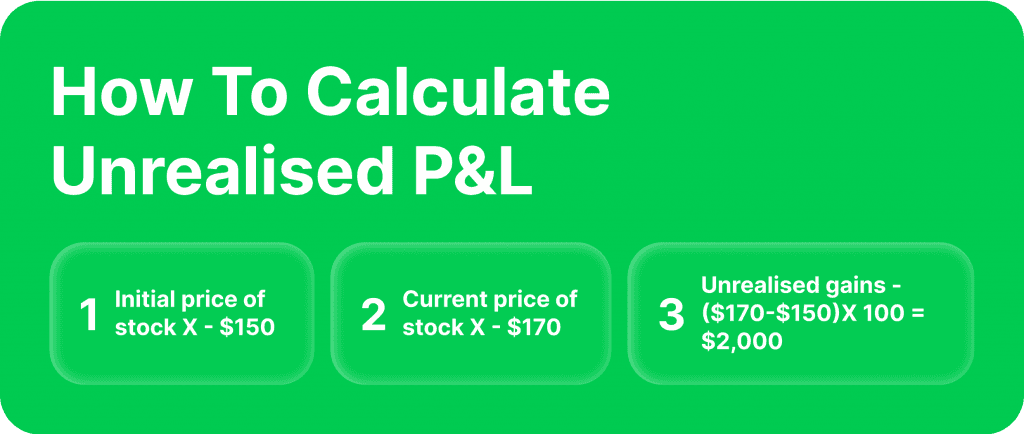

While the open P&L is an outstanding mechanism that helps you monitor your precise trading progression, it can be misleading to newcomer investors. The P&L report does not show the actual profits for respective traders. Instead, this report showcases the unrealised (or floating) profits or losses of all open positions owned by an investor. The unrealised gains are calculated by subtracting the initial purchase amount of tradable assets from the current price on the market.

As a quick example, let’s imagine trader A has purchased 100 shares in stock X, valued at $150 per share. After several weeks, the stock X has appreciated, boasting a current market price of $170. The unrealised profits in this case will be (170-150) X 100 = $2000.

However, it is crucial to understand that the above-outlined $2,000 should not be considered a realised profit, as the share price might change further. Suppose that stock X reverses its growth trend and returns to a $150 valuation. In this case, the open P&L will revert to showing zero profits in this position.

Thus, it’s easy to see why P&L numbers might mislead inexperienced traders. While well-educated investors are adept in this matter, newcomers might make the mistake of thinking that they have already generated $2,000. In reality, they still need to cash out their winnings by closing the position. Otherwise, the price fluctuations will continue, potentially reversing the unrealised gains completely.

However, it is not always the best idea to immediately cash out your profits. Thus, traders should not go in the opposite direction either, cashing in every unrealised gain they receive from an open P&L position. Some strategies might yield even bigger returns when cultivated correctly.

Therefore, the most optimal approach to assessing P&L positions is simply to view it as your current standing and potential profits. While the P&L should be rigorously checked to remain alert in the frequently changing landscape, it should not skew your trading decisions dramatically since this could lead to immature finalisations of various trading strategies and losing money in the long run.

Advantages of Assessing Your Open P&L Correctly

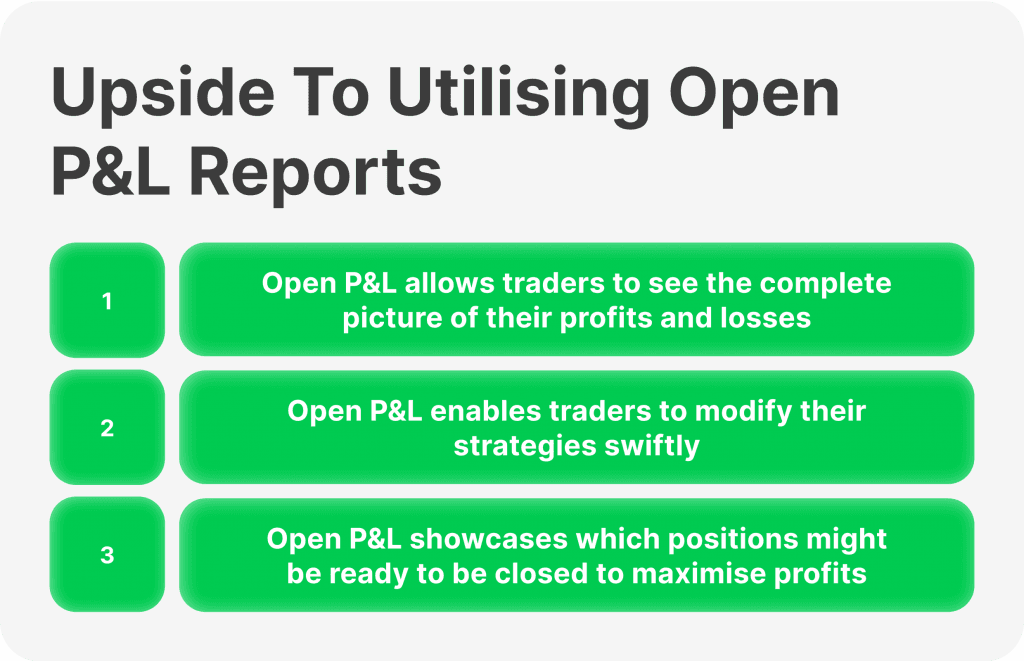

Despite the common misconceptions and pitfalls, open P&L should still be at the forefront of trading analytics for any investor. The trick, as outlined above, is to utilise the open P&L numbers without bias and avoid getting trigger-happy after seeing the unrealised open profits.

It is also crucial to remember that open P&L does not represent your cash flow statement, as the costs and gains showcased by this report are temporary and do not affect your portfolio directly. So, before drastically changing your strategy due to the rising or falling P&L numbers, you must first remember that nothing has materialised yet, and your portfolio is safe from losses.

Moreover, open P&Ls can paint a good picture regarding your general trading strategy. Most traders prefer to look at their open positions in accumulation. While assessing individual positions is crucial, understanding your current profitability level can give you more context on what to do next. For example, isolated positions might be profitable, but their general income might be lacklustre, prompting traders to become more aggressive in achieving their strategies.

The opposite is also true, with some losing positions not being a big deal in the context of the entire open P&L. Just like the profit or loss statement of companies, open P&L is all about assessing the more minor variables but keeping the bottom line in mind.

Final Remarks

Understanding Open P&L meaning is important to monitor your trades 24/7. It allows investors to navigate the risky market more fluidly and keep their priorities in check. After all, trading is all about making a profit and minimising losses. Open P&L statements make it easier to visualise the current success with open positions and let traders adjust their strategies without delay. However, it is crucial not to be misled by these reports and view the unrealised profits as actual profits.

Read also